AI infrastructure new baseline for funding

Here are 5 ways to reframe the thought process of an early-stage startup entrepreneur/CEO to help you identify and challenge wrong assumptions, working toward building the conviction needed to attract targeted future investors:

Avoid These 7 Mistakes CEOs Make in Series A Fundraising

Introduction

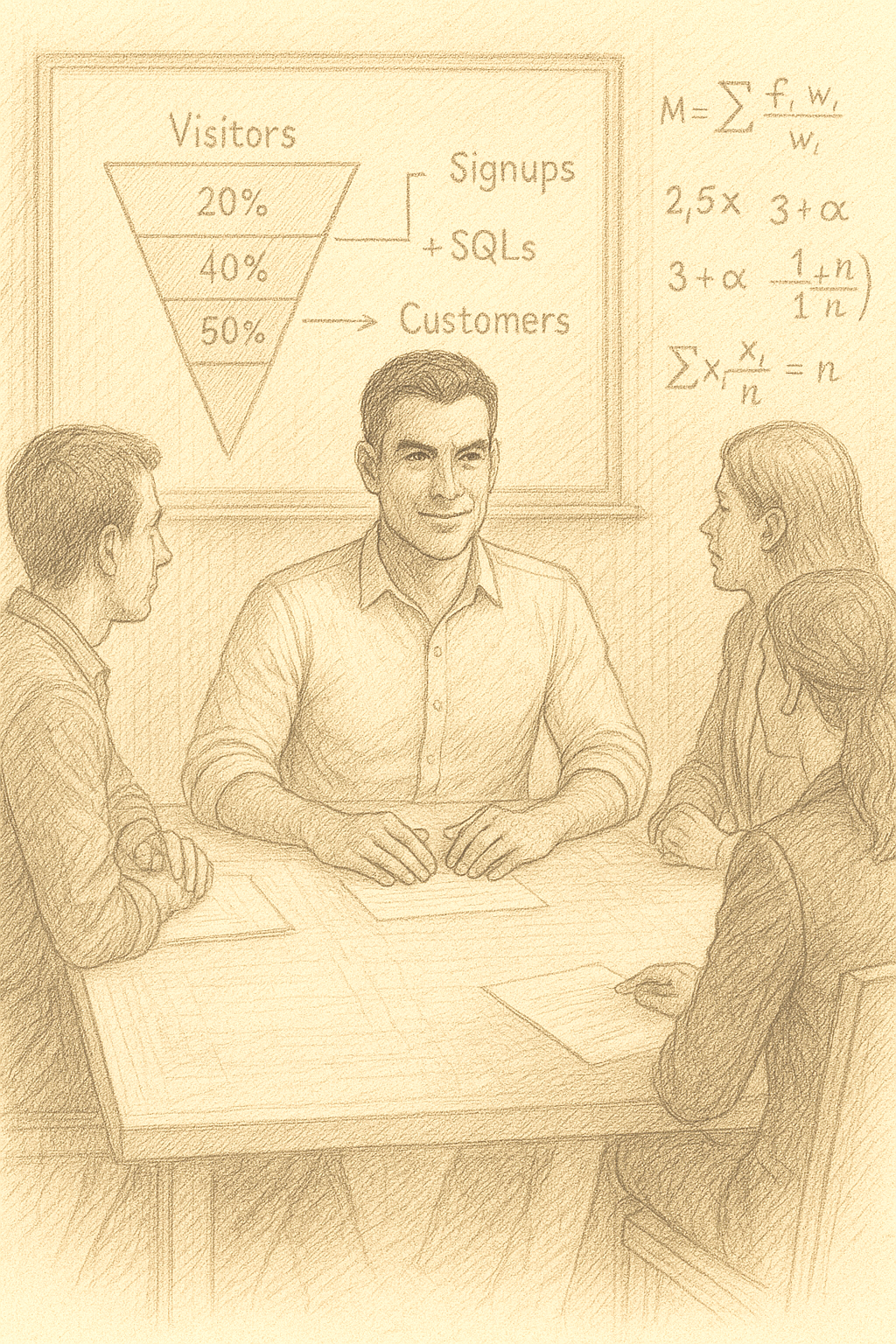

Series A fundraising separates the talkers from the builders. It’s no longer about selling a dream — it’s about proving a machine. At this stage, investors want control, clarity, and credibility. Most CEOs blow it by confusing effort with evidence. Vision gets you a meeting; discipline gets you a term sheet. The difference is how well you can show progress that scales, not just hope that spreads.

Mindset for Startups

Here are 5 ways to reframe the thought process of an early-stage startup entrepreneur/CEO to help you identify and challenge wrong assumptions, working toward building the conviction needed to attract targeted future investors: